Last summer, credit reporting agency Experian released some sobering data on Millennial credit scores. Older Millennials, or those between 29 and 35, have an average credit score of only 665, while younger Millennials aged 22 to 28 are an average of 13 points lower, at 652.

One Account Isn’t Always Enough: Why a Secondary Savings Account Just Makes Sense

Having a savings account is already a smart financial move, but adding a second one can take your strategy to the next level. A secondary savings account helps you manage your money with more clarity, intention, and organization. Whether you’re setting aside funds for a future trip, planning for seasonal expenses, or preparing for unexpected repairs, creating a separate account gives each goal its own space.

Rather than keeping all your savings in one place and trying to mentally divide the funds, a secondary account allows you to visually track and stay on target with individual goals. At We Florida Financial, opening a secondary savings account is simple and comes with no monthly maintenance fees, giving you more control without added cost.

Think saving money in a checking account is a waste of money? Think again.

In today's unpredictable world, establishing an emergency fund is a prudent step toward financial security. Such a fund should cover three to six months' worth of household expenses or unexpected events like major car repairs, significant medical bills, or even job loss. This financial cushion acts as a safeguard against unforeseen circumstances. Ideally, your emergency savings should be kept in an account that is easily accessible, offers competitive yields, and is fully insured against loss. Traditionally, options like Certificates of Deposit (CDs) or money market accounts were favored for their higher returns.

How To Prepare For Tax Season: How a Secondary Savings Account Can Make Tax Season Less Painful

Let’s face it—tax season can be a real headache. Whether you’re filing on your own or working with a tax preparer, the process is rarely enjoyable. And if you end up owing money to the IRS or your state government? That’s the cherry on top of a financially stressful sundae.

For many people, it’s not just the paperwork that’s overwhelming—it’s the payment. Having to suddenly come up with hundreds or even thousands of dollars can seriously derail your finances if you haven’t planned ahead. But here’s the good news: a little preparation throughout the year can make next tax season feel like no big deal.

Six Reasons to Switch to E-Statements

Quick, convenient and clutter-free, Electronic Statements are the way to secure your checking and savings account info.

Your We Florida Financial e-statements work similarly to paper bank statements, except for the fact that they’re delivered electronically. At the end of each statement period, you’ll get an email from your credit union informing you that your e-Statement is ready to view through online banking, the mobile banking app or another secure digital means. Once you access the e-Statement, you’ll find it has all the information you’re used to getting with your paper statements. You can also access your e-Statement by logging into your online banking site or mobile banking app at any time throughout the month. Signing up for e-statements is easy for South Florida members using Online Banking

Here are six reasons to consider switching to e-statements.

9 Tips for ATM Safety

With the sun setting by 6 pm since we fell back for Daylight Saving Time, it’s more important than ever to brush up on ATM safety. Using a compromised ATM can mean risking identity theft and/or having cash stolen.

Here are tips to help you keep your ATM transactions secure.

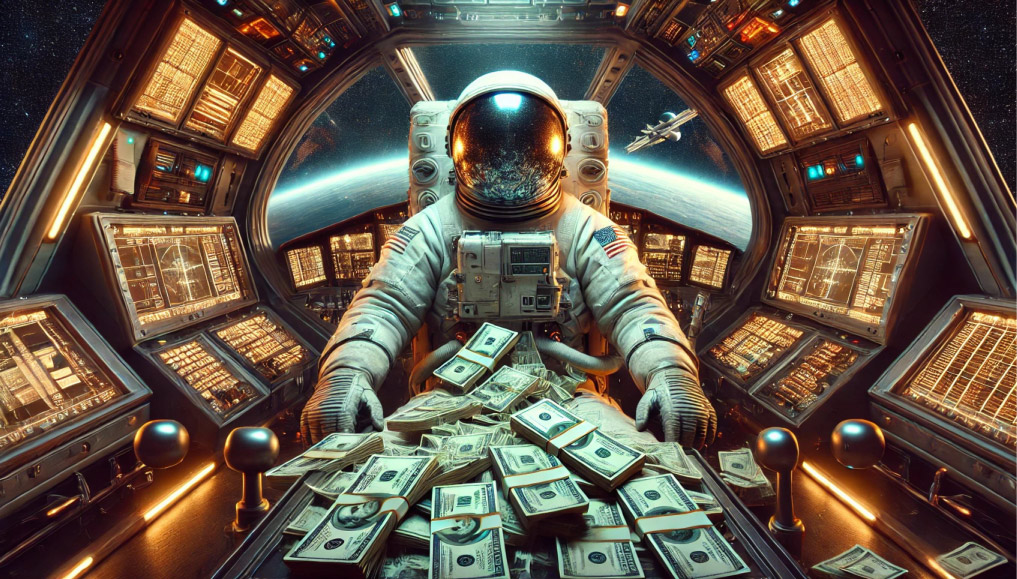

Why Chasing Crypto to the Moon Can Crash Your Finances: Meme Coin Risks

The Risks of Meme Coins vs. The Security of Long-Term Investments: Why CDs, Interest-Bearing Accounts, and Other Secure Options Are the Smarter Choice

In recent years, the rise of meme coins and viral investing trends has captured the attention of both novice and seasoned investors alike. Buzzwords like "to the moon" and "diamond hands" flood social media platforms, encouraging individuals to jump on the latest cryptocurrency bandwagon with the hope of striking it rich overnight. While the allure of quick profits is tempting, the reality is that these speculative investments come with significant risks. Conversely, secure financial products like Certificates of Deposit (CDs), Interest-Bearing accounts, and other low-risk investments offer stability, growth, and long-term financial peace of mind.

Join a credit union: Why it's recommended for new graduates

Why New Graduates Should Join a Credit Union

Being a new graduate, and presumably headed towards joining the workforce, becoming a member of a credit union is a wise move. But why should you join a credit union?

Home Equity Lines of Credit vs. Home Equity Loans

Home Financing 101: Home Equity Lines of Credit vs. Home Equity Loans

When it comes to home financing, a home equity loan can be categorized in two ways: a home equity line of credit and a home equity loan. While they may appear similar at first, they have fundamental differences that make one more appropriate than the other, depending on your needs.

Florida Home Loans: Buying a Second Home in the Sunshine State

Buying A Second Home in Florida: Home Loan Assistance

Now might be a good time to buy a second home in Florida while prices are still affordable. Whether you're buying a single-family home or a condo, We Florida Financial offers a fixed rate mortgages for Florida home loans.

Invest in Equity: Home Equity Loans from We Florida Financial

Home Equity Loans are an affordable and flexible source of funds for a variety of needs. Using Home Equity Loans for home improvement or remodeling projects means you are able to invest your money in the most beneficial place—your home.

Top Reasons to Own a Credit Card

Three Top Reasons to Own Credit Cards

Service fees and fears over identity theft shouldn't scare you away from carrying plastic for good. Here are some compelling reasons why you should consider, or reconsider, getting a credit card if you don't have one yet:

Personal Loans: Where To Get One?

Banks vs. Credit Unions for Personal Loans

Personal loans are generally used for a variety of things like education, starting a business, going on a vacation or medical expenses. When looking for a personal loan, banks are usually the first stop people make. However, credit unions offer personal loans as well, often at lower rates and longer terms.

Teaching the Power of Saving with Youth Accounts

In a world where financial literacy is more important than ever, teaching kids how to manage money can set them up for a lifetime of success. As parents, one of the best gifts we can give our children is the knowledge of how to save, earn interest, and understand the basics of money management. Opening a Youth Account is a fantastic way to start this journey.

The Qs and As about Credit Scores

What credit score should you really be striving for?

Most people have heard the old adage that the higher your credit score the better. We all know that a good credit score means lower rates when you want to obtain a loan on a car, mortgage and other large ticket item. The truth is that financial institutions use ranges to determine interest rates on a loan.

Leveraging IRAs and CDs to Fuel Your FIRE: A Roadmap to Financial Independence and Early Retirement

In the dynamic landscape of personal finance, one movement stands out for its bold ambition and innovative strategies: Financial Independence, Retire Early (FIRE). This paradigm shift in financial thinking champions the notion of breaking free from the traditional work-retire-die cycle and instead, achieving financial freedom at an early age. At the core of this movement lies a potent catalyst: Individual Retirement Accounts (IRAs), and a lesser-known yet valuable tool: Certificates of Deposit (CDs). Let’s explore how IRAs and CDs can synergize to turbocharge your journey to FIRE and pave the way for a life of purpose, passion, and autonomy.

What are CDs and IRAs?

Are you thinking about investing but aren’t sure where to begin? CDs and IRAs are a good, low risk place to start. In this blog, we will explain just what these are and when it would be a good time to invest.

Uncovering Hidden Gems: Lesser-Known Tax Deductions to Ease Your Tax Burden

As tax filing deadlines get ever closer, the annual ritual of sorting through receipts and forms to uncover potential deductions can add an extra layer of stress to an already overwhelming season. But fear not, for amidst the sea of paperwork lies a treasure trove of often-overlooked deductions that could significantly reduce your tax bill. While the tried-and-true deductions like mortgage interest and charitable contributions are familiar to many, delving deeper into the tax code reveals a wealth of lesser-known opportunities to save.

6 Tips for a Scam-Free Summer

Don’t get scammed this summer! Follow these 6 tips to stay safe.

1. Never pay for a “prize” vacation

If you’re asked to pay a small fee to claim a free vacation prize, you’re looking at a scam. A legitimate company will never ask winners to do that.

2. Use a credit card when traveling

A credit card offers you the most protection in case something goes wrong. You’ll be able to dispute unauthorized charges, and in most cases, reclaim your lost funds. Some cards even offer certain travel perks that help your trip go off without a hitch.

Navigating Holiday Expenses: A Guide to Financial Bliss

'Tis the season for festive cheer and the occasional pang of holiday wallet worry. Fear not, We Florida Financial is here to sprinkle some financial wisdom into your celebrations. In this guide, we'll sleigh through the holiday season with savvy spending tips, thoughtful gifting ideas, and a touch of We Florida Financial magic.