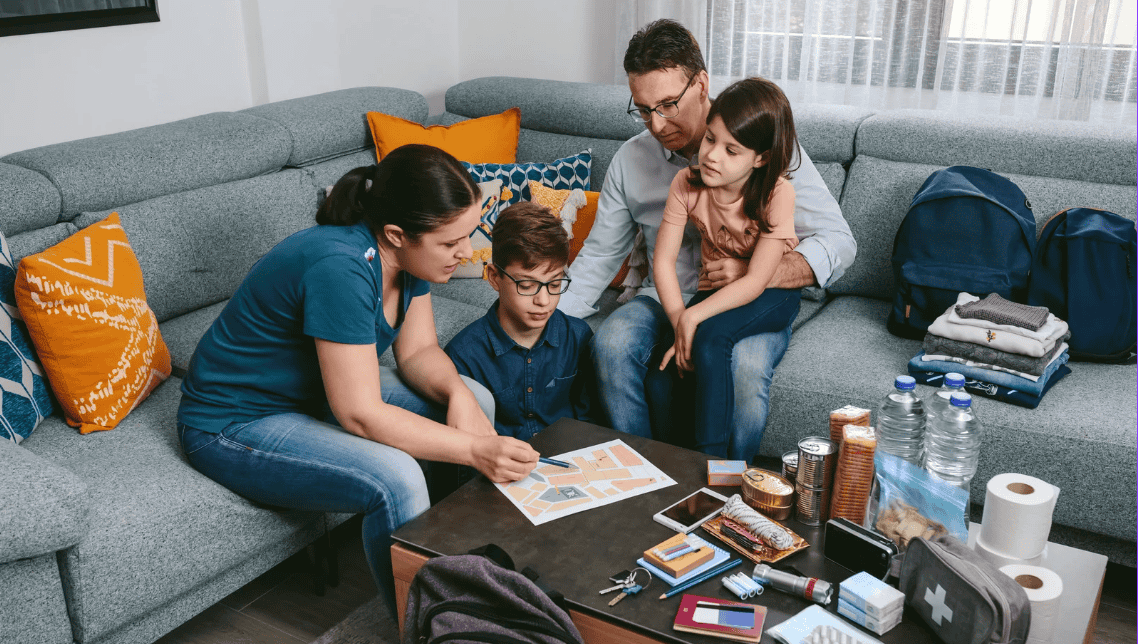

Having a savings account is already a smart financial move, but adding a second one can take your strategy to the next level. A secondary savings account helps you manage your money with more clarity, intention, and organization. Whether you’re setting aside funds for a future trip, planning for seasonal expenses, or preparing for unexpected repairs, creating a separate account gives each goal its own space.

Rather than keeping all your savings in one place and trying to mentally divide the funds, a secondary account allows you to visually track and stay on target with individual goals. At We Florida Financial, opening a secondary savings account is simple and comes with no monthly maintenance fees, giving you more control without added cost.